Belgium, the Democratic Republic of Congo’s (DRC) former colonial power, continues to hold a strategic stake in the country’s mining sector—particularly in diamonds and critical metals. Amid rising global competition for Congo’s mineral resources, Brussels is signaling its intention to deepen ties with Kinshasa.

Belgium’s Foreign Minister Maxime Prévot recently expressed his country’s willingness to strengthen collaboration with the DRC in mining. While Kinshasa’s official response is pending, it’s worth revisiting the existing economic links between the two nations in the mineral resources sector.

Belgium: A Key Market for Congolese Diamonds

While Belgium is not an active miner in the DRC, it is a major buyer of Congolese diamonds, largely due to Antwerp’s status as a global diamond trading hub.

In 2024, the DRC exported 4.1 million carats of diamonds to Belgium, valued at approximately $42.03 million, according to the DRC’s Ministry of Mines. This made Belgium the second-largest importer of Congolese diamonds, after the United Arab Emirates, which received 4.9 million carats valued at $44.9 million.

Strategic Metals: Belgium’s Growing Role

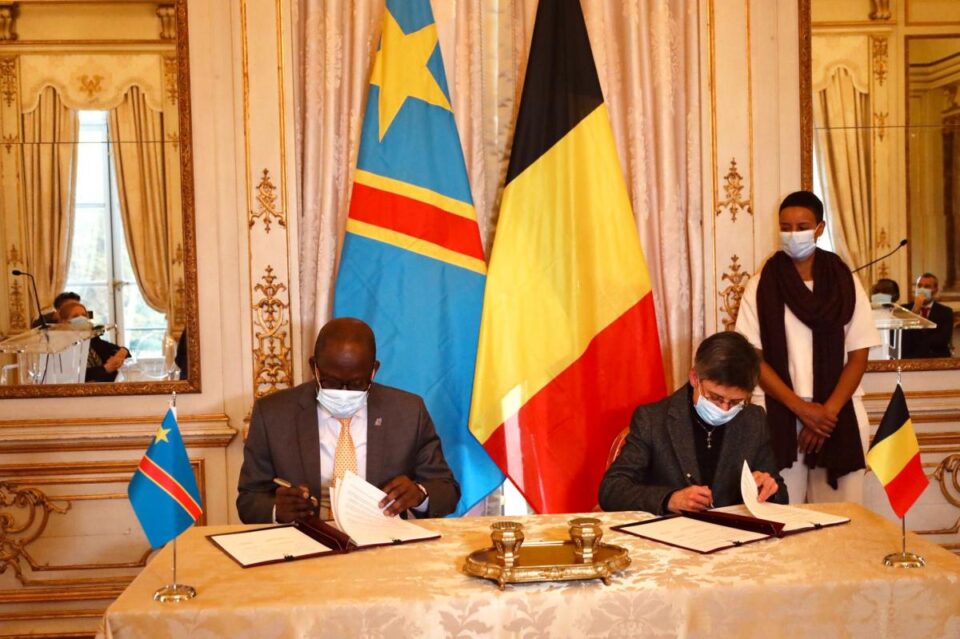

Belgium’s influence is also growing in the critical metals space—an increasingly vital sector as global demand for rare minerals intensifies. Through Umicore, a Belgian metal processing and recycling firm, Belgium is partnering with Gécamines, the DRC’s state-owned mining company, to challenge China’s dominance in germanium supply.

In 2024, Gécamines and Umicore signed a deal to refine germanium concentrates from Lubumbashi’s “Big Hill” tailings site. The first exports to Belgium began in October 2024, supporting Gécamines’ goal to supply up to 30% of global germanium demand.

“Belgium has globally recognized expertise with companies like Umicore and John Cockerill, who can process a wide range of critical materials,” said Minister Prévot.

Future Collaboration: Opportunities Ahead

While Belgium has yet to make firm investment pledges, it has signaled interest in expanding its role in the DRC’s mining value chains. As China deepens its control and the U.S. increases its presence through mineral security agreements, Belgium seeks to position itself as a “win-win” industrial partner.

Potential areas for cooperation include:

- Modernizing the diamond sector, where production has dropped significantly since 2017.

- Deepening Umicore’s involvement to support local value addition for strategic metals.

- Improving traceability in mineral supply chains, through technical and financial support—critical for transparency and global compliance.

- Advocating for the DRC in the EU, particularly in disputes like the 2024 EU-Rwanda critical minerals agreement, which has drawn opposition from Kinshasa.